Introduction

Looking to buy a mobile home? It's important to understand the market value, factoring in location, setting a realistic budget, considering additional costs, and researching financing options. Finding the perfect mobile home at the right cost is crucial for your peace of mind and financial stability.

Understanding the Market Value

When it comes to buying a mobile home, understanding the cost for a mobile home is essential. Knowing the current market value will help you make an informed decision and avoid overpaying for your new home. At PreFab Inc., we understand the importance of getting the best value for your money.

Factoring in Location

Location plays a significant role in determining the cost for a mobile home. Factors such as proximity to amenities, quality of schools, and overall safety can impact prices. Whether you're looking for a quiet suburban setting or an urban lifestyle, understanding how location affects costs is key to finding your dream mobile home.

Setting a Realistic Budget

Setting a realistic budget is crucial when considering purchasing a mobile home. It's not just about the initial purchase price; you also need to factor in potential renovation costs, utility and maintenance expenses, land rental or purchase fees, insurance, taxes, and upgrading to energy-efficient features. PreFab Inc. can help you navigate through these essential financial considerations.

Considering Additional Costs

In addition to the purchase price of a mobile home, there are several additional costs that need to be considered before making your decision. These include land rental or purchase fees, insurance premiums and property taxes that vary by location and energy-efficient upgrades that can save you money in the long run.

Researching Financing Options

Researching financing options is critical when purchasing a mobile home as it can significantly impact your long-term financial stability. While traditional mortgages are an option, chattel mortgages specifically designed for manufactured homes may be more suitable for some buyers. Government assistance programs may also be available to help with financing your new home at PreFab Inc.

Researching the Market Value

When it comes to purchasing a mobile home, understanding the cost is crucial. Online tools such as Zillow and Redfin can provide valuable insights into the current market value of mobile homes in your desired area. These platforms allow you to filter search results based on specific criteria, helping you gauge the average cost for a mobile home.

Online Tools for Valuation

Utilizing online tools for valuation is a convenient way to get an estimate of the cost for a mobile home without leaving your home. By inputting details such as location, size, and amenities, these tools can generate a rough estimate of the property's worth. Keep in mind that while these estimates are useful, they may not always reflect the true value of a mobile home.

Consulting Mobile Home Dealers

Engaging with reputable mobile home dealers can provide valuable insights into the current market value. These professionals have extensive knowledge of local pricing trends and can offer personalized advice based on your specific needs and preferences. By consulting with them, you can gain a better understanding of what to expect in terms of cost for a mobile home.

Assessing Comparable Sales

Another effective way to gauge the cost for a mobile home is by assessing comparable sales in your target area. By researching recent transactions involving similar properties, you can identify patterns and trends in pricing. This approach allows you to make informed decisions when it comes to budgeting for your new mobile home.

Location, Location, Location

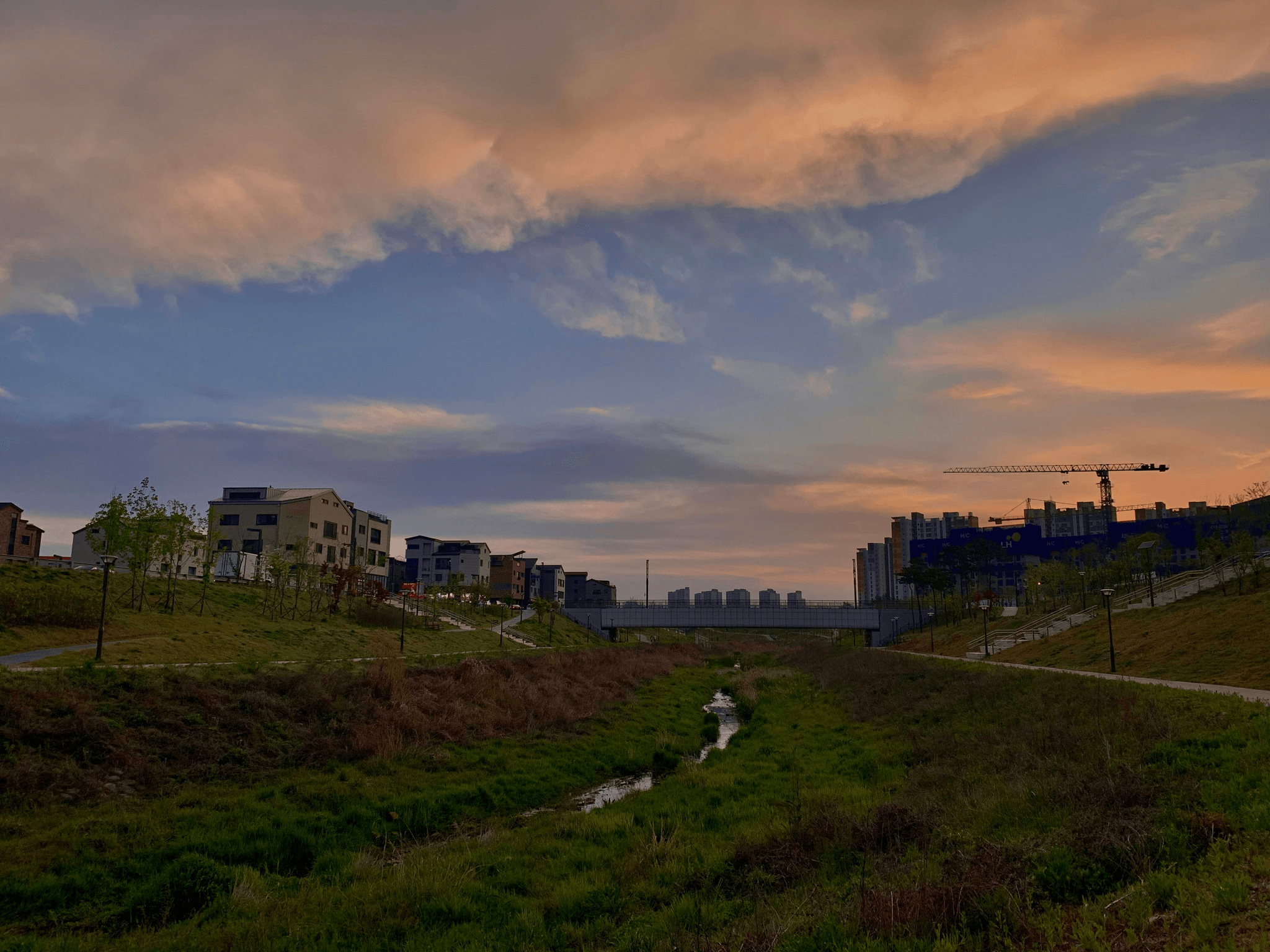

When it comes to the cost for a mobile home, location plays a significant role. The demand for mobile homes in certain areas can drive up prices, while more remote locations may offer more affordable options. Whether you're looking for a beachfront property or a secluded countryside retreat, the location will have a direct impact on the cost for a mobile home.

Different regulations in different areas can also affect the cost for a mobile home. Zoning laws and local building codes vary from place to place, influencing the availability and cost of land for your mobile home. It's important to research these regulations thoroughly before making any decisions about where to settle down with your new home.

There are pros and cons to consider when it comes to different settings for your mobile home. While urban areas may offer convenience and access to amenities, they often come with higher costs. On the other hand, rural or suburban settings may provide more space and tranquility at a lower price point. It's essential to weigh these factors carefully when determining the best location for your budget and lifestyle.

PreFab Inc. understands that finding the right location is crucial in determining the overall cost of your mobile home investment. With our expertise in navigating various regulations and market trends, we can help you make an informed decision that aligns with your financial goals while fulfilling your dreams of homeownership.

Setting Your Budget

When it comes to setting your budget for a mobile home, there are several key factors to consider. The initial purchase price of the home itself is obviously a major consideration. You'll also need to factor in potential renovation costs if you're looking at older models or ones that need some TLC. And don't forget about ongoing utility and maintenance expenses, which can add up over time.

Initial Purchase Price

The cost for a mobile home can vary widely depending on factors such as size, age, and location. It's important to do thorough research and compare prices from different sellers before making a decision. At PreFab Inc., we offer a range of options to suit different budgets, so you're sure to find something that fits your financial needs.

Potential Renovation Costs

If you're considering purchasing an older mobile home or one that needs some updating, it's crucial to budget for potential renovation costs. This might include things like new flooring, appliances, or even structural repairs. It's always wise to have a buffer in your budget for unexpected expenses that may arise during the renovation process.

Utility and Maintenance Expenses

In addition to the initial purchase price and potential renovation costs, it's essential to consider ongoing utility and maintenance expenses when setting your budget for a mobile home. This includes things like monthly utilities, regular maintenance tasks, and any unexpected repairs that may pop up along the way. Planning ahead for these expenses can help you avoid financial stress down the road.

Additional Costs to Consider

When considering the cost for a mobile home, it's important to factor in the expenses related to land rental or purchase. Land rental fees can vary depending on location, with some areas being more expensive than others. If you're looking to purchase land, research the average prices in your desired area and include that in your budget planning. PreFab Inc. can provide guidance on these additional costs and help you make an informed decision.

Land Rental or Purchase

Image description={A colorful infographic showing different land rental fees in various states across the country, with text indicating average costs and popular locations}, Image name={land-rental-fees}, Alt tag={Cost for a mobile home - Average land rental fees}

Land rental fees for a mobile home can range from $200 to $800 per month, depending on the location and amenities provided by the park. It's essential to research different parks and their associated costs before making a decision. Some parks may include utilities in their rental fees, while others may charge extra for these services.

Insurance and Taxes

When budgeting for your mobile home, don't forget to consider insurance and taxes as part of the ongoing expenses. Mobile home insurance typically covers damage caused by fire, theft, vandalism, and natural disasters. The cost of insurance can vary based on factors such as location, age of the home, and coverage limits. Property taxes are another expense that varies by state and should be factored into your overall budget.

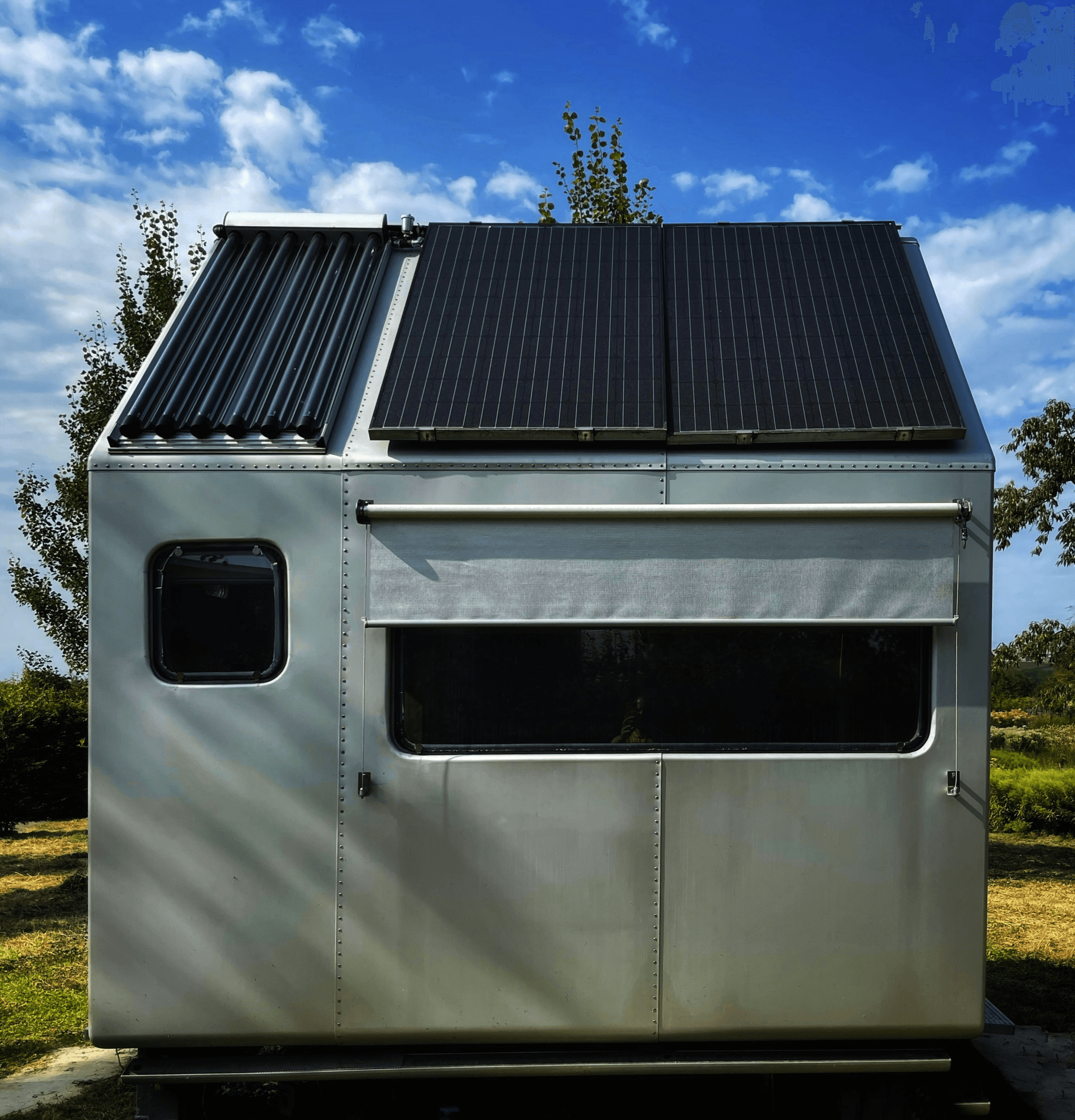

Upgrading to Energy-Efficient Features

Upgrading your mobile home with energy-efficient features can lead to long-term cost savings on utility bills. Consider adding insulation, energy-efficient windows, LED lighting, and high-efficiency appliances to reduce energy consumption and lower monthly expenses. While there may be upfront costs associated with these upgrades, they can ultimately contribute to a more sustainable and cost-effective living environment.

By carefully considering these additional costs when planning for your mobile home purchase, you can make informed decisions that align with your financial goals while enjoying all the benefits of modern living.

Exploring Financing Options

When it comes to financing your mobile home, you have a few options to consider. Traditional mortgages are available for mobile homes that are permanently affixed to a foundation on owned land, while chattel mortgages are more common for homes located in mobile home parks. Government assistance programs can also provide financial support for those looking to purchase a mobile home. Additionally, at PreFab Inc., we offer flexible financing options tailored to your specific needs and budget.

Traditional Mortgage vs Chattel Mortgage

Traditional mortgages are ideal for those looking to purchase a mobile home and land together, as they offer lower interest rates and longer repayment terms compared to chattel mortgages. On the other hand, chattel mortgages are designed specifically for the purchase of the mobile home itself, making them more suitable for homes located in parks where the land is not owned by the homeowner.

Government Assistance Programs

There are various government programs available that provide financial assistance to individuals looking to buy a mobile home. These programs often offer low-interest loans or grants to help cover the cost of purchasing and/or renovating a mobile home, making homeownership more accessible for those with limited financial resources.

Financing through PreFab Inc.

At PreFab Inc., we understand that every individual's financial situation is unique. That's why we offer flexible financing options tailored to your specific needs and budget. Whether you're looking to purchase a new or pre-owned mobile home, our team will work with you to find the best financing solution that fits your lifestyle and financial goals.

Conclusion

Finding the perfect mobile home can be an exciting journey, but it's important to make an informed decision every step of the way. By carefully considering the market value, location, budget, additional costs, and financing options, you can secure your dream mobile home without breaking the bank.

Making an Informed Decision

When it comes to purchasing a mobile home, knowledge is power. Researching the market value and understanding the impact of location on cost will ensure that you are making a well-informed decision. Consulting with experts at PreFab Inc. can also provide valuable insights into finding the best mobile home for your needs.

Securing Your Dream Mobile Home

Once you have identified the perfect mobile home for you, it's time to take steps to secure it. Whether you choose to rent or purchase land for your mobile home, obtaining insurance and planning for potential upgrades are crucial in ensuring that your dream becomes a reality.

Planning for Long-Term Financial Stability

Owning a mobile home is not just about the initial purchase; it's about planning for long-term financial stability. Considering utility and maintenance expenses as well as energy-efficient features will help you save money in the long run and ensure that your investment remains valuable over time.

Remember that purchasing a mobile home is not just about finding a place to live; it's about making a smart financial decision that will benefit you in the long run. With careful planning and research, you can find a beautiful and affordable mobile home that meets all your needs while securing your financial future.